puerto rico tax incentives 2020

Puerto Rico has a long history of using tax incentives and credits as tools for economic development and recovery after economic crises. Also during the year 2012 two additional laws.

Guide To Income Tax In Puerto Rico

Any other tourism sector if the Secretary of the DDEC determines that the operation is necessary and convenient for the development of tourism in Puerto Rico.

. As of January 1. Published May 2019 updated July 2020. Changes to Act 2022 New Incentives Code of Puerto Rico for Jan 1 2020.

There is no doubt that Puerto Rico taxes offer incredible incentives to move to the island. 4 Fixed Income Tax Rate on Income related to export of services or goods. It allows you to slash your corporate tax rate to only 4.

As of January 1 2020 Act 20 and 22 have been replaced by Act 60 which brings with it some. To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify. By providing a multitude of tax incentives it is meant to attract high.

The legacy Act 20 and Act 22 incentives are not the only tax incentives available in Puerto Rico. Benefits of establishing relocating or expanding businesses in Puerto Rico. 50 income tax credit for investment in machinery and equipment for the production of energy using renewable resources.

Most recently then Governor of. Please note that the new Incentives Code made Act 22 more expensive in 2020. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect.

To benefit from the tax incentives you have to meet specific requirements though. In fact Puerto Rico offers a morphine drip of other financial incentives. For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim.

Puerto Rico Tax Incentives. The Act 60 program was put in place with the aim to facilitate the recovery of Puerto Ricos economy. Puerto Rico Tax Incentives.

A qualified individuals income from dividends and interest are exempt from Puerto Rico income taxes during the exemption. These have mainly come in the form of tax incentives Act 20 and Act 22 but there are a number of other minor incentive acts in place. Just declaring the US territory your new home is not.

The goal of Act 20 and 22 was to attract entrepreneurs to the island with tax incentives for establishing businesses in Puerto Rico. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. 0 Taxes on Dividends and Interest.

One of the most well-known Puerto Rican tax incentives the Individual Resident Investor tax incentive is available to any person who was not a resident of Puerto Rico for the. First in order to qualify for Act 22 you need to make an annual donation to official charities in. Ten 10 years Part I Detail of Net Operating Losses for Regular Tax Purposes 00 00 00 00 00 00 00 00 00 00 00 00 00 1 2 3 4 5 6 7 8 9 10.

Then in 2019 the two acts were. 50 income tax credit of qualified R. These include a fixed corporate income tax rate one.

For US federal income tax purposes income derived in Puerto Rico and income tax paid to Puerto Rico are generally treated in the same manner as income derived in and taxes paid to a foreign. Puerto Rico offers the security and stability of operating in a US jurisdiction with. Puerto Rico tax and incentives guide 2020 5 Although economic growth has decreased during the last years Puerto Rico offers tax incentives packages which can prove attractive to companies from the United States and other countries.

Make Puerto Rico Your New Home. As of 2020 Puerto Rico actually. 28 May 2021.

2019 California For Puerto Rico Solidarity Pledge Puerto Ricans In Action

Puerto Rico Workers Yes Colonizers No Workers World

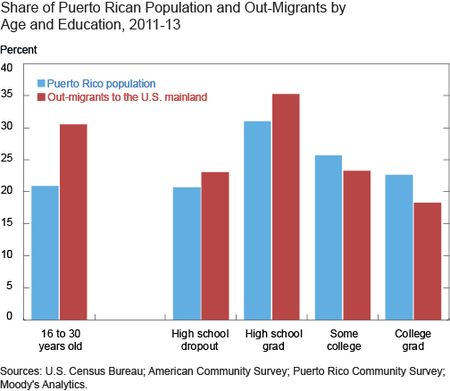

Population Lost Puerto Rico S Troubling Out Migration Liberty Street Economics

Carveouts From Overseas Profits Tax Sought For Us Territories Roll Call

2019 California For Puerto Rico Solidarity Pledge Puerto Ricans In Action

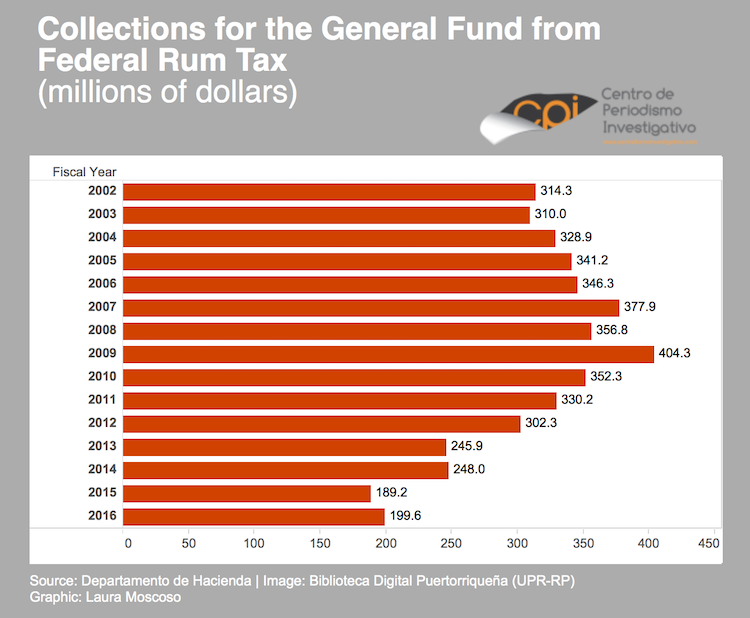

Centro De Periodismo Investigativo Puerto Rico S Unlimited Generosity Towards Rum Companies Centro De Periodismo Investigativo

Puerto Rico Workers Yes Colonizers No Workers World

A Focus On Puerto Rico S Tax Climate Miles Consulting Group

2021 Puerto Rico State Hazard Mitigation Plan By La Coleccion Puertorriquena Issuu

Why Puerto Rico Puerto Rico Turnkey Properties

Puerto Rico Workers Yes Colonizers No Workers World

Wealthy Investors Are Buying Property In Puerto Rico Driving Up Prices For Locals Rogue Rocket

Puerto Rico Incentives Code Act 60 2019 Signed Into Law Relocate To Puerto Rico With Act 60 20 22

Guide To Income Tax In Puerto Rico

Guide To Income Tax In Puerto Rico

Disaster Relief Program Established For Hurricane Hit Businesses In Puerto Rico Synergi Partners

2019 California For Puerto Rico Solidarity Pledge Puerto Ricans In Action

Trump Tweet About Puerto Ricans Being Us Citizens Opinion Cnn